How to Securely Redact Bank Statements and Financial Documents Using AI in 2025

How to Securely Redact Bank Statements and Financial Documents Using AI in 2025

Picture this: You're applying for a business loan, and the lender requests your bank statements. You hesitate—those statements contain far more than just your income. Every coffee purchase, every medical payment, every personal transaction sits there, ready to be scrutinized by strangers. This isn't paranoia; it's a legitimate privacy concern in an age where a single overlooked detail can expose your entire financial life.

The stakes have never been higher. Data breaches cost companies an average of $4.88 million per incident in 2024, and financial documents remain prime targets for cybercriminals. Yet most people still rely on black markers or basic PDF tools to "hide" sensitive information—methods that are shockingly easy to reverse. The good news? AI-powered redaction technology has transformed document security from a tedious, error-prone process into something you can accomplish in minutes with enterprise-grade protection.

This guide walks you through everything you need to know about securely redacting bank statements and financial documents in 2025. You'll discover how AI detects sensitive information humans often miss, learn which compliance regulations affect you, and get step-by-step instructions for permanent, irreversible redaction. Whether you're a freelancer sharing income verification, a business owner handling loan applications, or simply someone who values privacy, you'll leave with practical tools to protect your financial information without sacrificing transparency.

What Is Bank Statement Redaction and Why It Matters in 2025

Bank statement redaction is the process of permanently removing or obscuring sensitive information from financial documents before sharing them with third parties. According to Redactable, this practice enables you to share necessary financial information while keeping your most sensitive details private and secure.

When redacting bank statements and financial documents, you should focus on protecting several key pieces of information. Account numbers, Social Security numbers, credit card details, transaction descriptions, addresses, and other personally identifiable information should be carefully removed before sharing. The goal is to provide only the specific information required by the requesting party—such as proof of income or account ownership—while maintaining your privacy protection.

The Legal Landscape Driving Redaction Requirements

In 2025, multiple compliance frameworks make proper redaction not just a best practice, but a legal necessity. The Gramm-Leach-Bliley Act (GLBA) requires financial institutions to protect the privacy, confidentiality, and security of consumer financial information through three core rules: the Privacy Rule, Safeguards Rule, and Pretexting Rule. These regulations mandate that organizations implement comprehensive security programs to safeguard customer data.

PCI-DSS compliance is essential for any organization handling credit card information, requiring strict security standards to prevent data breaches and fraud. The regulation's 2022 updates in PCI DSS 4.0 have expanded requirements for protecting cardholder data throughout its lifecycle.

Additionally, GDPR impacts how European consumer data must be handled, while FOIA (Freedom of Information Act) requests often require careful redaction of bank account numbers and sensitive information from public records. Understanding these overlapping requirements is crucial for anyone handling financial documents in 2025.

The Evolution: Traditional vs AI-Powered Redaction Methods

Remember the last time you grabbed a black marker to hide sensitive information on a document? That manual approach, while still common, is riddled with problems that could cost you dearly. Traditional redaction methods—whether using physical markers or basic PDF tools—are slow, error-prone, and surprisingly risky. In fact, improper redaction can expose organizations to civil liability and even disciplinary action when sensitive data isn't truly removed.

The speed difference alone is staggering. While manual review of documents takes hours, AI-powered tools can redact a 10-page document in just 2.5 minutes. But it's not just about speed—it's about accuracy. Research shows that AI redaction significantly outperforms manual methods, achieving higher accuracy rates while reducing the human error that plagues traditional approaches.

Modern solutions like Smallpdf's AI-powered redaction tool represent this evolution perfectly. Unlike basic tools that simply place black boxes over text (which can often be removed or reversed), AI-powered platforms permanently remove sensitive information while maintaining document integrity. They automatically detect and redact Personally Identifiable Information (PII), Social Security Numbers, credit card details, and financial data—information that manual reviewers might easily miss in lengthy bank statements.

The risks of sticking with old methods extend beyond mere inefficiency. Manual redaction leaves organizations vulnerable to data breaches and compliance violations, potentially exposing customer financial data, violating GDPR or HIPAA regulations, and damaging your reputation. In 2025, when one oversight can trigger a costly breach, AI-powered redaction isn't just convenient—it's essential protection.

How AI-Powered Redaction Technology Works

Think of AI redaction as having a highly trained assistant who can scan thousands of documents in seconds, spotting every instance of sensitive information without missing a single detail. Unlike traditional manual redaction that relies on tired human eyes, AI-based redaction uses machine learning algorithms to automatically detect and permanently remove personally identifiable information (PII) from your financial documents.

![]()

The technology works through sophisticated Named Entity Recognition (NER), which transforms unstructured text into organized, categorized data. When you upload a bank statement, the AI simultaneously processes multiple layers of information. First, it uses optical character recognition to scan even image-based attachments, ensuring scanned documents receive the same thorough treatment as digital files.

Next comes pattern recognition—the AI's superpower. Automated redacting software leverages pattern recognition features to detect specific information types like Social Security numbers (###-##-####), credit card details (sixteen-digit sequences), bank account numbers, and transaction amounts. For instance, when processing your statement, AI can identify and flag your account number (1234567890), routing number, wire transfer codes, and even seemingly innocuous details like beneficiary names or merchant information that could expose your spending patterns.

Modern AI redaction tools like Smallpdf's redact PDF feature combine this intelligent detection with user-friendly interfaces, allowing you to review AI suggestions before permanent redaction. The system doesn't just find obvious data—it recognizes contextual clues, understanding that "John Smith" next to a dollar amount likely represents a payee requiring protection.

Step-by-Step Guide: How to Redact Bank Statements Securely Using AI

Redacting sensitive financial information doesn't have to be complicated. Modern AI-powered tools have transformed what used to be a tedious manual process into something you can accomplish in minutes. Here's your practical roadmap to secure bank statement redaction using AI.

Step 1: Choose Your Redaction Tool

Start by selecting a platform designed for permanent data removal, not just visual masking. Smallpdf's Redact PDF tool stands out as the optimal choice for most users, offering TLS encryption, GDPR compliance, and automatic file deletion after processing. Unlike traditional PDF annotation tools that create visual overlays, professional redaction solutions actually remove data from the document structure, including metadata and hidden information.

Step 2: Upload Your Document Securely

Upload your bank statement to your chosen platform. With tools like Smallpdf, you simply drag and drop your PDF into the browser—no software installation required. The file is immediately encrypted during transmission, protecting your financial data throughout the process.

Step 3: Mark Sensitive Information

Here's where AI shines. Modern redaction tools automatically detect and highlight sensitive information including account numbers, Social Security numbers, addresses, and transaction details. According to redaction experts, AI-powered auto mode can identify financial data patterns across your entire document in seconds. You can also manually drag over any additional text or numbers you want to protect.

Step 4: Review and Apply Permanent Redaction

Before finalizing, carefully review all marked areas. The redaction process should include verifying that all account numbers, transaction descriptions, and personal identifiers are selected. Once confirmed, apply the redaction—this permanently removes the data, not just covers it with black boxes.

Step 5: Validate and Download

Your final step is validation. Check that redacted areas appear as solid blocks with no underlying data. Download your secured document, knowing that sensitive information has been completely removed from the file structure, making it safe for sharing with landlords, loan officers, or other authorized parties.

Top AI Redaction Tools for Financial Documents in 2025

Choosing the right redaction tool for bank statements and financial documents depends on your specific needs, budget, and compliance requirements. Here's a breakdown of leading solutions that cater to everyone from individuals to enterprise organizations.

Best for Individual Users: Smallpdf's Redact-PDF.AI

For individuals and small teams handling occasional financial document redaction, Smallpdf's Redact-PDF.AI stands out as the optimal choice. This cloud-native solution offers an intuitive drag-and-drop interface where you simply upload your PDF, highlight sensitive information, and download your permanently redacted document. What sets Smallpdf apart is its commitment to security—featuring TLS encryption, GDPR compliance, and automatic file deletion after processing. Unlike many free tools that sacrifice security for convenience, Smallpdf maintains enterprise-grade protection without the complexity or cost of full enterprise solutions. It's perfect for freelancers, small business owners, and anyone who needs to redact bank statements before sharing them with accountants, lenders, or partners.

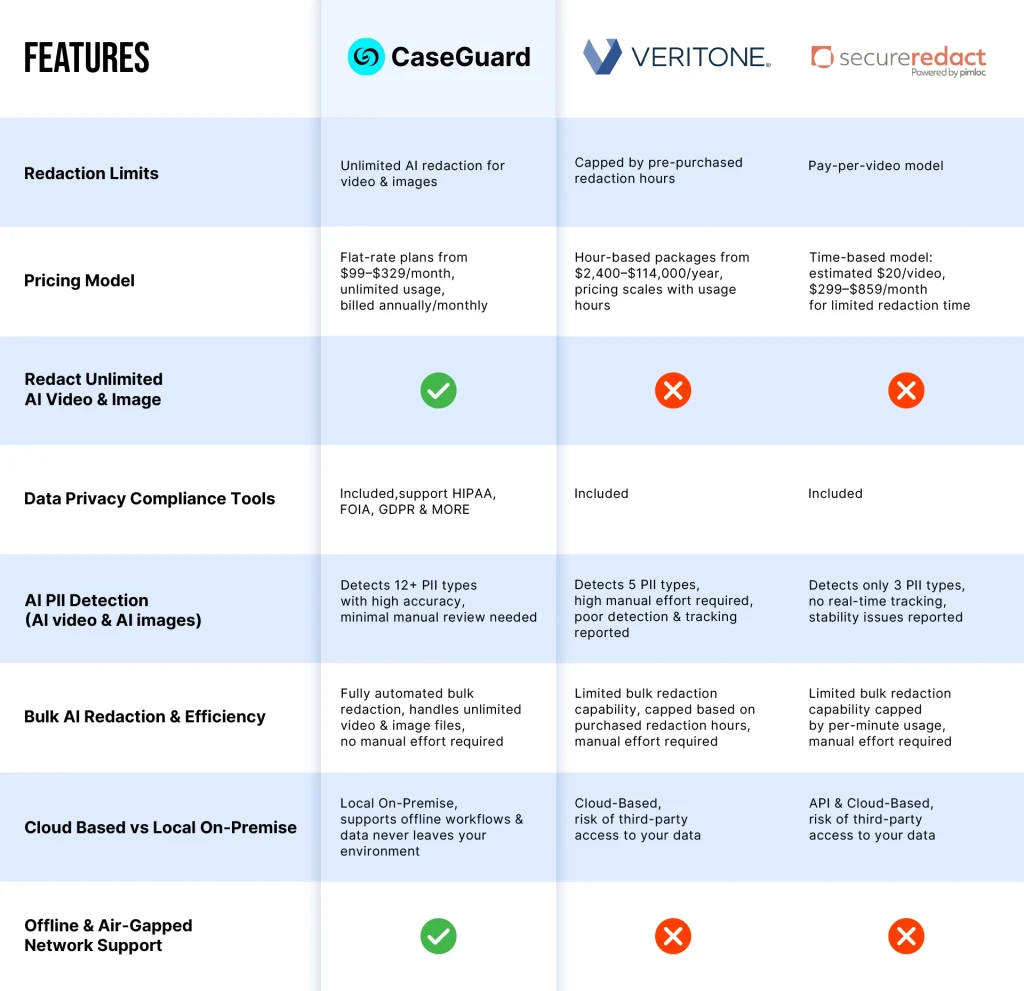

Enterprise Solutions: CaseGuard and Redactable

For organizations requiring advanced compliance capabilities, CaseGuard and Redactable offer robust enterprise features. CaseGuard excels in video and audio redaction alongside document processing, making it ideal for financial institutions handling multimedia evidence. Redactable, trusted by US government agencies including the Air Force, provides AI-powered PII detection with category-based classification and FOIA-specific features—essential for organizations with strict regulatory requirements. According to Financial Industry Regulatory Authority research, AI systems specifically trained on financial documentation can reduce review time by 50-60% while ensuring compliance across jurisdictions.

Both platforms offer SOC 2 and ISO 27001 certifications, automated workflow integrations, and audit trails—features that justify their higher price points for regulated industries.

How to Securely Redact Bank Statements and Financial Documents Using AI in 2025

Picture this: You're applying for your dream apartment, and the landlord requests your bank statements. Your heart sinks as you imagine a stranger scrutinizing every coffee purchase, online subscription, and weekend splurge from the past three months. Sound familiar? You're not alone—millions of people face this privacy dilemma every day when sharing financial documents.

The good news? You don't have to choose between protecting your privacy and meeting verification requirements. Modern AI-powered redaction technology has transformed how we secure sensitive financial information, making it possible to share necessary details while keeping everything else confidential. Whether you're self-employed applying for a loan, proving income for a rental application, or submitting documents for legal proceedings, understanding proper redaction isn't just convenient—it's essential protection against identity theft, fraud, and unnecessary exposure of your personal financial life. In this comprehensive guide, we'll walk you through everything you need to know about securely redacting bank statements and financial documents using cutting-edge AI technology, from choosing the right tools to avoiding common mistakes that could compromise your data.

Compliance and Security Best Practices for Financial Document Redaction

Protecting financial documents requires more than just blacking out sensitive data—it demands a comprehensive security framework. Whether you're handling bank statements, loan applications, or payment records, following compliance best practices ensures you meet regulatory requirements while safeguarding confidential information.

Critical Security Measures for Financial Redaction

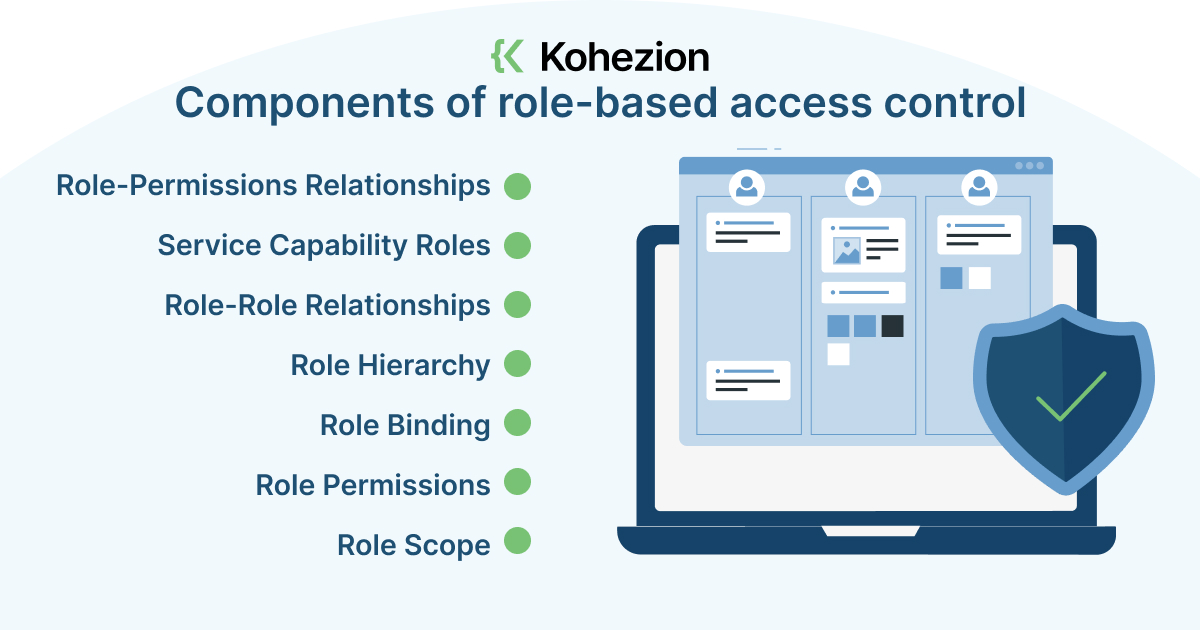

According to Financial Services Data Security & Compliance: 2025 Guide, organizations must implement robust access controls and encryption protocols. Start by establishing role-based access controls (RBAC) that limit document access to authorized personnel only. Each user should have precisely the permissions they need—nothing more, nothing less.

Encryption during processing is non-negotiable. As outlined in Understanding PCI DSS Encryption Requirements in 2025, organizations must use strong encryption algorithms for data at rest and in transit, particularly when handling cardholder data. Modern redaction solutions like Smallpdf's Redact PDF tool prioritize this security layer with TLS encryption and automatic file deletion after processing, ensuring your documents remain protected throughout the redaction workflow.

Maintaining Audit Trails and Compliance Documentation

Every redaction action should generate an audit trail. What Is Redaction? The Complete Guide for 2025 emphasizes that compliance with regulations like PCI-DSS, GDPR, and GLBA requires detailed documentation of who accessed documents, what information was redacted, and when changes occurred. This documentation proves invaluable during compliance audits and security investigations.

Before deploying any redaction solution, conduct thorough accuracy testing. Review redacted documents to verify that sensitive information is permanently removed—not just visually obscured. PCI DSS Compliance Checklist 2025 recommends regular security assessments to ensure your redaction processes meet evolving compliance standards.

Real-World Use Cases: When You Need to Redact Bank Statements

Understanding when and why to redact financial documents is crucial for protecting sensitive information while maintaining necessary transparency. Let's explore the most common scenarios where secure redaction becomes essential.

Business Loan Applications and Self-Employment Income Verification

Self-employed individuals and business owners frequently need bank statement loans when traditional income documentation falls short. However, lenders only need to verify income deposits—not your personal spending patterns or unrelated account details. This is where strategic redaction proves invaluable. According to Griffin Funding's analysis of bank statement loan use cases, borrowers can protect their privacy while still demonstrating qualifying income by redacting irrelevant transactions, maintaining both transparency and confidentiality.

Rental Applications and Address Verification

Landlords typically require bank statements for proof of address and financial stability, but they don't need access to every transaction detail. Smart redaction allows prospective tenants to show consistent income and account ownership while protecting spending habits and personal merchant relationships. Research shows that property managers increasingly accept redacted statements when key verification elements remain visible.

Legal Proceedings and Insurance Claims

During litigation or insurance claim processing, attorneys and adjusters often request financial documentation. Modern AI-powered claims processing systems are transforming how insurers handle documentation, reducing processing times by up to 60% while maintaining accuracy. However, oversharing creates unnecessary privacy risks. Redaction ensures courts and insurance companies receive only relevant information while protecting unrelated financial activities from discovery.

For professionals handling these sensitive documents regularly, Smallpdf's Redact PDF tool offers a streamlined solution with drag-and-drop simplicity, TLS encryption, and GDPR compliance. The platform automatically deletes files after processing, providing enterprise-grade security that makes document redaction both quick and secure—typically completing tasks in under a minute versus the hours manual redaction requires.

Common Mistakes to Avoid When Redacting Financial Documents

Even with the best intentions, redaction failures can expose sensitive data and create serious compliance risks. Understanding these common pitfalls will help you protect your financial information effectively, whether you're working with bank statements, tax returns, or investment documents.

Incomplete or Partial Redaction is perhaps the most dangerous mistake. According to VIDIZMO's analysis of redaction software failures, partial redaction leaves identifying details exposed, creating the illusion of security while actually maintaining privacy risks. Always verify that all instances of sensitive data—including account numbers, SSNs, and addresses—are fully obscured across the entire document.

Using Reversible Methods creates a false sense of security. Common mistakes in document redaction reveal that simply blanking out text or using highlighting tools doesn't permanently remove information. These methods allow data recovery through simple copy-paste or layer adjustments. Modern solutions like Smallpdf's Redact PDF tool ensure permanent removal by actually deleting the underlying data, not just covering it up.

Overlooking Hidden Metadata is a critical oversight. Research on redaction failure risks shows that "hidden" text often remains in file properties, metadata, and document history. Before sharing any financial document, use tools that automatically scrub this hidden data—or manually verify through file properties and document inspection features.

Failing to Verify Permanence leads to costly mistakes. Always test your redacted document by attempting to select, copy, or search for the supposedly hidden information. If any sensitive data remains accessible, your redaction isn't complete and requires proper tools that meet modern compliance standards like GDPR and HIPAA.

How to Securely Redact Bank Statements and Financial Documents Using AI in 2025

Picture this: You're applying for a business loan, and the lender requests your bank statements. You know they need to see your income deposits, but do they really need access to every Netflix subscription, medical bill, or personal purchase you've made? Of course not. Yet millions of people hand over unredacted financial documents every day, unknowingly exposing themselves to identity theft, fraud, and privacy violations. In 2025, with data breaches costing companies an average of $4.88 million per incident, protecting your financial information isn't just prudent—it's essential.

The good news? You don't need to be a cybersecurity expert to protect your sensitive data. AI-powered redaction tools have transformed what used to be a tedious, error-prone manual process into something you can accomplish in minutes from your browser. Whether you're a freelancer sharing tax documents with an accountant, a tenant providing proof of address to a landlord, or a business owner applying for financing, secure redaction ensures you share only what's necessary while keeping your private information exactly that—private. This guide walks you through everything you need to know about modern redaction technology, from choosing the right tools to avoiding common mistakes that could compromise your security.